Disrupt Your Life!

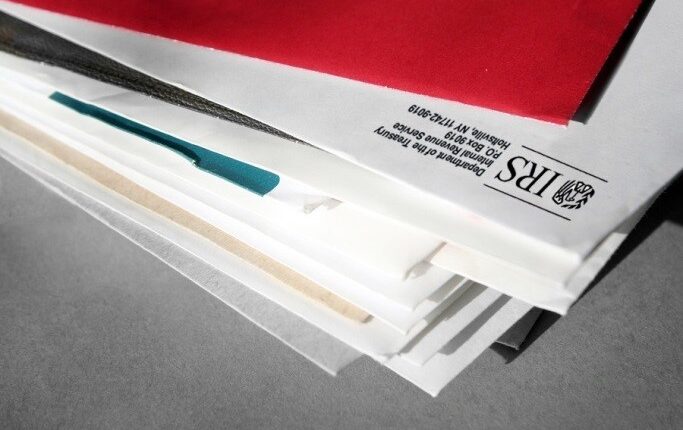

Our Audit Assistance and Protection Plan will give you Audit Representation Protection if you get any notice from the IRS and Full Tax Identity Theft Recovery. It will shield you from the time, money, and frustration you will undergo if you try to resolve these issues yourself.

Did you know???

Tax Identity Fraud is on the rise. In the past two years alone, more than 1,500,000 Americans have had their tax identity stolen, with $6.2 billion that was fraudulently claimed. So, yes, it happens a lot more than you realize. How are you supposed to prove that you are you?

If You Received An Audit Notice, What Would You Do?

We Guarantee a “Worry-Free” Audit Protection And Assistance All The Way!!!

Our Services Include

AUDIT PROTECTION AND ASSISTANCE

With our Audit Protection Plan we’ll protect you from ever having to deal with the tax authorities by yourself in case you get a notice from the IRS.

Read More

TAX PROBLEM RESOLUTION

We are committed to giving you a comprehensive understanding of your tax issue. Once we verify the extent and accuracy of tax issue…

Read More

IDENTITY THEFT RESOLUTION

Tax Identity Fraud is on the rise. In the past two years alone, more than 1,500,000 Americans had their tax identity stolen, with $6.2 billion…

Read More

REPRESENTATION BEFORE THE IRS

if you are ever summoned to meet with an IRS agent in person, how comforting will it be for you to know that we’ll attend on your behalf?

Read More

STOP COLLECTION AND GARNISHMENT ACTIONS

Wage garnishment is the deduction of money from an individual’s income for the purpose of paying off debts that they owe…

Read Moretestimonials

Amanda Seyfried

Consulting WP really helped us achieve our financial goals. The slick presentation along with fantastic readability ensures that our financial standing is stable.

Debbie Kübel-Sorger

The demands for financial institutions have changed a bit. Obfuscation is no longer accepted, which is why this Business WordPress Theme is so perfect.

Donald Simpson

Consulting WordPress Theme is the way to go for financial institutions. We take pride in being a transparent and perfection oriented organization, and Consulting WP perfectly represents us.

Christian Marcil

We thought a lot before choosing the Financial WordPress Theme because we wanted to sure our investment would yield results. This was clearly the best choice, it combines a fantastic design with great UI.

Cintia Le Corre

When you are in the financial industry you know the image you have to project to people. You have to be agile and authoritative; Consulting WP lets us show clients that we are slick yet also have substance.

Bianca Hammound

Prior to joining Consulting WP, Bianca ran a project management software firm in the U.S. and worked in consulting and investment banking.

Would you like to speak to one of our financial advisers over the phone? Just submit your details and we’ll be in touch shortly. You can also email us if you would prefer.